I've been learning about investment strategies lately and I've found these resources to be the most valuable ones for me.

Personal Investment Strategy

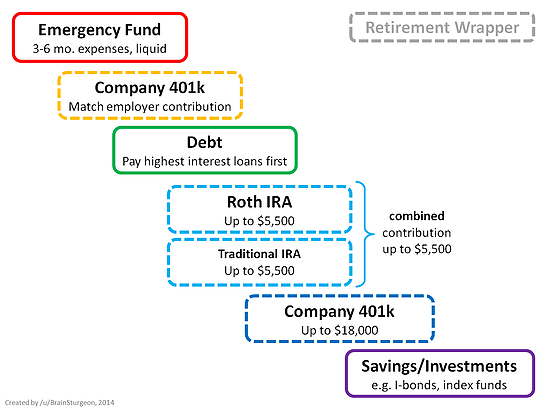

At the end of the day, all I'm really looking for a way to think about money, what I should do with it and how to organize a plan. This little graphic is incredible because it pretty much tells me that before I start buying stocks and bonds, I should first make sure I have an Emergency Fund, a Company 401k and my debts paid off. Then the list keeps going and going until I'm finally able to buy securities. Thank you infographic!

How Money Works in the Modern Age

This video explains how money works in the modern age. Here's a hint: debt has now replaced gold.

The Financial Industry

This video does an excellent job of explaining how the machine works.

Good Reads

I read a lot, a whole lot and these books are actually worth reading. They're all kind of different but I guess that's the point.

-

If you know absolutely nothing about stocks, bonds, CDO's, REIT's, TIPS, Money Market Funds, etc. Then I would seriously start with Tony Robbin's book Mastering the Money Game. It's probably the most comprehensive book out there to help explain the dozens of financial products available to help you increase wealth. On top of that, he tries to organize these products in such a way that you can actually make sense of them. From Tony's point of view, financial products are simply tools. Therefore, it's important to know what tool to use and when to use it. I don't agree with the book all the time but I appreciate how much time is spent on spelling everything out. It's almost like an encyclopedia of products with strategies on how to use them.

-

Jack Bogle's The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns is excellent for understanding the basics of investing. This book is a home run but it will make even more sense after you read the Tony Robbins book.

-

Benjamin Graham's The Intelligent Investor is fantastic if you want to learn value investing, THIS IS THE BIBLE. The author is legendary and the concepts are timeliness.

-

John Brook's Business Adventures is a little bit dated but very good at explaining business history lessons.

-

Michael Lewis' The Big Short is the best book for explaining Credit Default Swaps, Collateralized Debt Obligations, Tranches and all the words used during the 2008 collapse. Again, this book is sort of advanced and really helpful once you understand some investing basics so I'd read the other books beforehand.